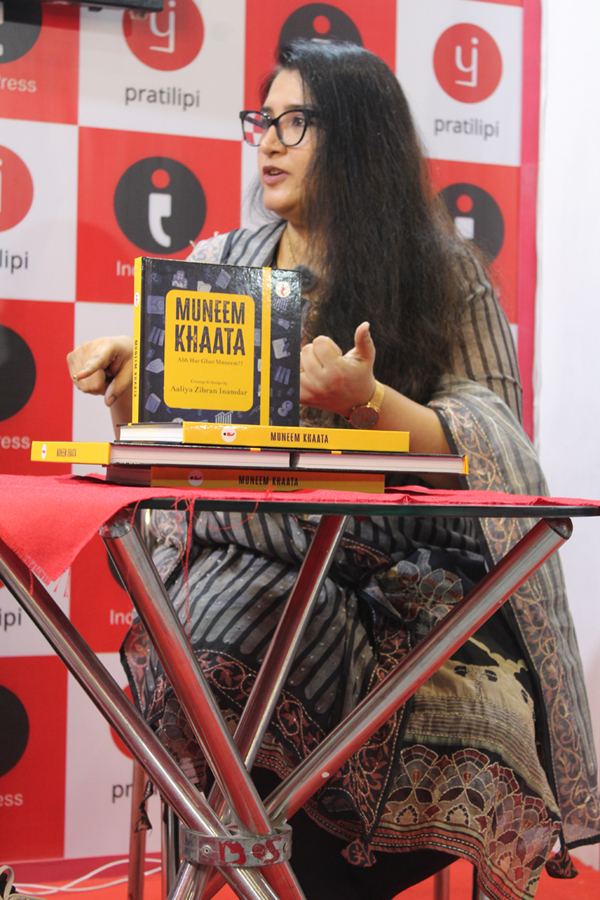

Handling personal finances can be a daunting task, especially in today’s hectic world. That’s where Muneem Khaata by Aaliya Inamdar steps in—a thoughtfully crafted financial planner aimed at streamlining money management. This practical tool offers a clear, structured path to long-term financial planning. Whether you’re just starting your financial journey or are a seasoned investor, Muneem Khaata serves as a reliable companion to help you stay on top of your finances. Now available at leading airport bookstores across India, it’s the perfect time to take charge of your financial future.

- What motivated you to create ‘Muneem Khaata,’ and how does it tackle current financial issues?

The inspiration for Muneem Khaata stemmed from my own financial journey and the need to make financial tracking simpler for everyone. In an era marked by digital overload and limited financial literacy, this planner offers a tangible and user-friendly way to organize finances. It closes the gap in financial planning by enabling users to track assets, liabilities, and future goals all in one secure, offline space. - What are some of the key takeaways readers can expect from the book?

Muneem Khaata imparts several essential financial lessons, including:

- Creating a Financial Legacy – Keep financial documents well-organized for easy future reference.

- Emergency Planning – Store key details like insurance and account information for quick access.

- Retirement Preparation – Map out a solid strategy for long-term financial stability.

- Asset & Liability Clarity – Get a clear picture of your financial situation.

- Educational Support – Understand the basics of savings, investments, and portfolio planning.

- Could you give examples that show why financial organization is so important?

Certainly! One major concern is the increase in unclaimed bank deposits, now totaling over Rs 78,213 crore—largely due to forgotten accounts and lack of documentation. Muneem Khaata helps prevent such losses by encouraging systematic tracking of financial assets. Another case involves surviving spouses facing difficulty in retrieving financial information—this planner ensures vital data is readily available when needed. - What obstacles did you face while writing this planner, and how did you overcome them?

Initially developed as a personal tool, Muneem Khaata had to be refined to meet the needs of a wider audience. With insights from mentors and financial professionals, I transformed it into a comprehensive and accessible planner. Balancing simplicity with thorough coverage of financial essentials was the main challenge, but it was overcome with consistent feedback and iteration. - What impact do you hope your book will have on readers’ financial behavior?

My goal is to help readers take charge of their financial lives, prepare for unexpected events, and secure their futures. Muneem Khaata is more than just a planner—it’s a dependable financial partner that promotes clarity, organization, and peace of mind. - How does ‘Muneem Khaata’ maintain its relevance in a constantly evolving financial world?

The planner is built to evolve with its users. As your financial situation changes, you can continue updating it. While digital tools may become outdated, Muneem Khaata remains a timeless solution—keeping financial organization straightforward and effective.

Organize your finances today—because a secure future begins with financial clarity.

Get your copy of Muneem Khaata on Amazon or pick it up from prominent airport bookstores across India: Relay – T1, Bangalore, WH Smith – T3, Delhi, Kolkata & Hyderabad, Bookscetra – T2 Departure, Mumbai, Relay – Terminal 1B, Mumbai.